Monday: Discretionary exit cut gains short. Missed with trend RL trades.

Tuesday: Simple M top, but lacked courage to get in on trend PB's.

Wednesday: No trades market very sloppy before FOMC

Thursday: Simple W bottom, again missed a with trend RL.

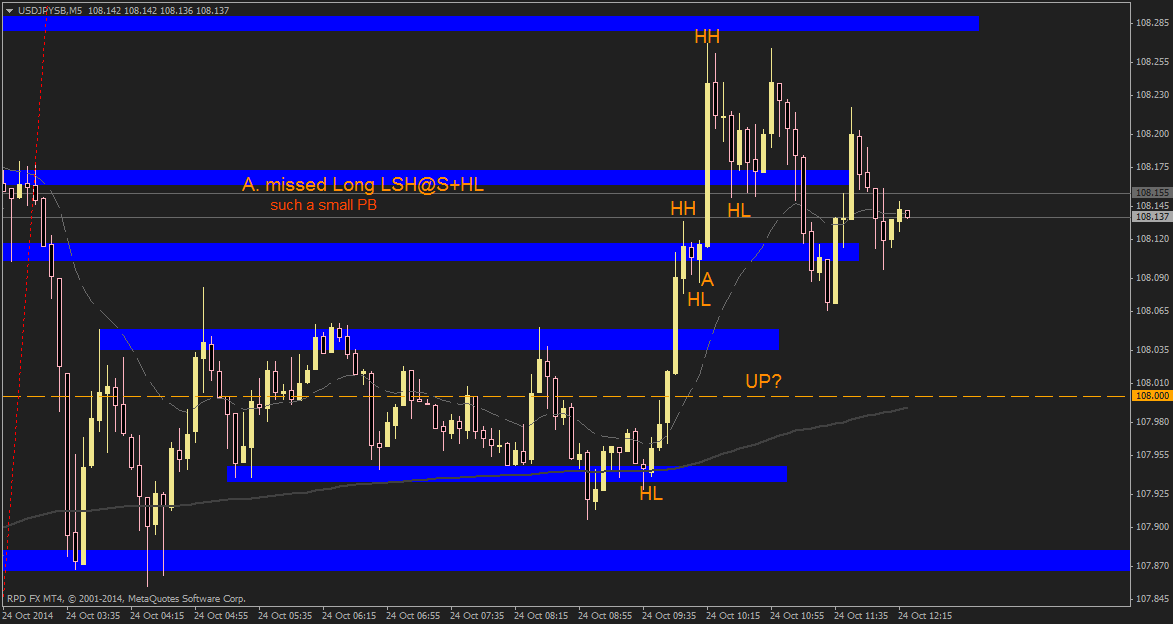

Friday: hard trend created by BOJ, struggled to get in on PB's no doubt due to my apprehension regarding the trend trades this week.

Notes: First profitable week in a long time. All trades were reversals however I don't think this reflects why the week was profitable as I clearly missed some good with trend PB and RL trades. Started the week quite fearful of HMs and SSs after getting ripped up by them last week. Think/know this fear transferred into fear of doji, hi wave and narrow range bars all of which usually occur at PBs and RLs so completely debilitated me in these situations. Ironically I was reading "naked forex" this week which is particularly good at defining good and bad HMs and SSs so this started to dissipate towards the end of the week but threw me as I was trying to follow my statement from last week not to trade HMs and SSs.

Summary: Continue to trade classic M tops and W bottoms. Re-read "naked forex" chapters on HM's and SS's and apply rules to my trading strategy over the weekend to regain courage in entering with trend on PBs/RLs. Take every setup that meets my critrea (PB/RL on S&R or S/R failure) remembering I can always SAR should they go against me.

_______________________________________________________________________________

UPDATE 031114

Basically I want to trade every Bull and Bear Sweet Spot be it counter trend or a with trend PB/RL with the exception of those with trend setups whose triggers are HMs and SSs that ...

- print after a large correction

- Don't stick out of consolidation (HM lower/SS higher)

- Don't occur on S/R level major or minor

AND SAR any with trend trades that fail.

In the last 2 weeks of the 22 with trend setups only 4 failed to reach the next level of S/R! An 80% success rate.