So this marks the 4.5 year of my trading and I'm still in a hole...

Summary: finding trading peers and mentor through blogging and learning Al Brooks method have dramatically changed my trading and confidence...

What I have come to realize in the past couple of months is that I did not know how to trade correctly. To be precise I did not know how to read/prep price action correctly. My methods up to that point were lagging and so I often ended up on the wrong side of the market when taking trades, despite following my rules exactly. Until the past couple of months I worked on everything except my price action reading convinced it was always going to be a bit "here or there" and believed that simply managing risk, following my plan and staying disciplined would put the odds in my favour eventually. But in reality I was not reading price action correctly and so even with the best discipline, psychology and risk management I was only ever going to lose money, albeit slowly.

Keeping this blog has changed my trading entirely. I am a self taught trader, up until I started this blog my only lessons had come from books and experience. I was not a huge fan of forums, finding them overly opinionated and occasionally intimidating.

This blog and getting involved in the "community of blogging traders" has changed my trading entirely because I am no longer isolated and now finally have peers and a mentor, pointing me in the right direction and sharing in my experiences and theirs for that matter.

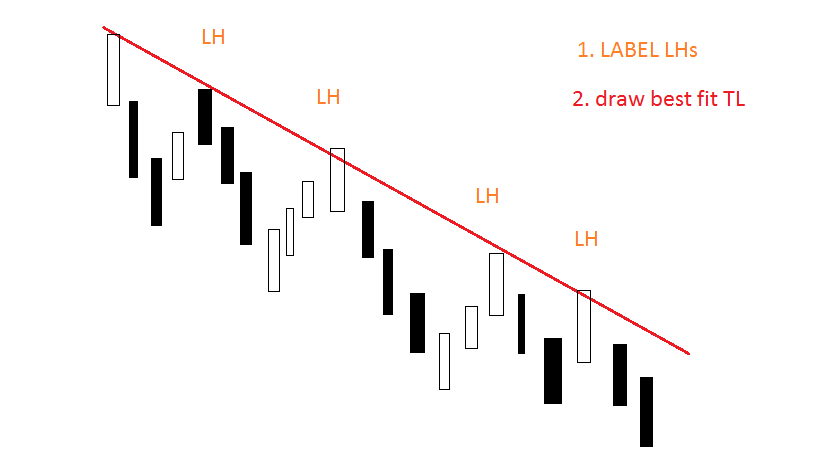

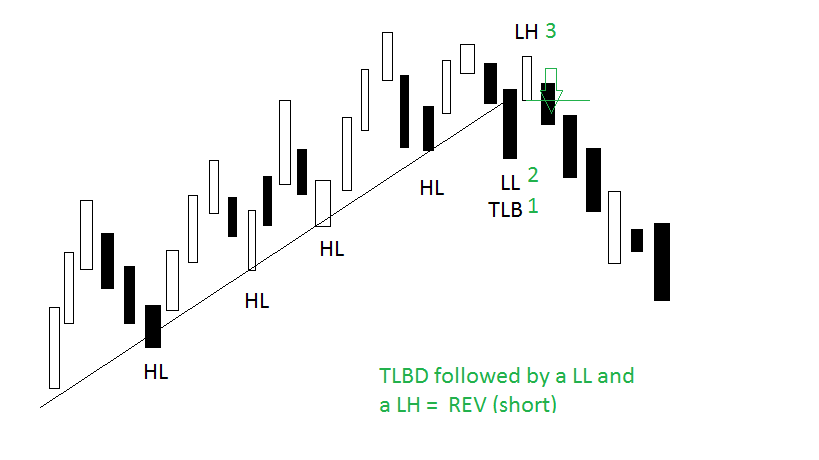

The second biggest thing to have happened to my trading this year was a blogging friend putting me on to Al Brooks, despite not entirely agreeing with all of his principles he knew this was what I needed and it has changed everything. I no longer feel the need or want to have indicators on my chart because I understand how to read price action correctly. I still have a long way to go in terms of entries but my reads have improved exponentially and I am now for the first time identifying more correct trades than incorrect ones and I am in time with reversals instead of lagging behind them like a fat walrus. I feel confident in what I am doing and where I am going.

FACTS

Summary: So despite this new method I am still sinking deeper with my intraday trades. There are 3 major problems. 1. I still sometimes get the direction wrong, especially when I'm rushing and not taking S&R into account. 2. Entries have been very late because I have not been tracking my Buy/Sell stops when they aren't initially triggered, I also need to think about entering on a S/R level rather than a candle level. 3. I have been suffering outcome bias recently so have been exiting perfectly good trades early for fear of creating a larger loss. My risk management has always been very good. But other than that as you can see everything needs work on and this is how I'm going to start the year. Work on the Prep, Work on the Patience, work on the (in trade) Discipline....

I am now going to also put up a weekly PL curve and trade summary a la MBA and Scalping the Stretch. They're right this game is about making money and I don't look at my PL curve enough!

This year I have basically had 3 trading methods

Methods 2&3 developed by myself which both lost money (090713-151013)....

| Summary: | |||||||||||||

| Deposit/Withdrawal: | 0.00 | Credit Facility: | 0.00 | ||||||||||

| Closed Trade P/L: | -446.00 | Floating P/L: | 0.00 | Margin: | 0.00 | ||||||||

| Balance: | 2 225.16 | Equity: | 2 225.16 | Free Margin: | 2 225.16 | ||||||||

| Details: | |||||||||||||

| Gross Profit: | 666.73 | Gross Loss: | 1 112.73 | Total Net Profit: | -446.00 | ||||||||

| Profit Factor: | 0.60 | Expected Payoff: | -3.63 | ||||||||||

| Absolute Drawdown: | 452.22 | Maximal Drawdown: | 506.87 (18.60%) | Relative Drawdown: | 18.60% (506.87) | ||||||||

| Total Trades: | 123 | Short Positions (won %): | 68 (26.47%) | Long Positions (won %): | 55 (16.36%) | ||||||||

| Profit Trades (% of total): | 27 (21.95%) | Loss trades (% of total): | 96 (78.05%) | ||||||||||

........................................................................................................................................................

The final (3rd) method is basically based off an Al Brooks method and has achieved (151013-231213)... The up moves in the PL were created by swing trades. The problems are listed in the facts summary above.

| Summary: | |||||||||||||

| Deposit/Withdrawal: | 0.00 | Credit Facility: | 0.00 | ||||||||||

| Closed Trade P/L: | -149.69 | Floating P/L: | 0.00 | Margin: | 0.00 | ||||||||

| Balance: | 2 225.16 | Equity: | 2 225.16 | Free Margin: | 2 225.16 | ||||||||

| Details: | |||||||||||||

| Gross Profit: | 112.57 | Gross Loss: | 262.26 | Total Net Profit: | -149.69 | ||||||||

| Profit Factor: | 0.43 | Expected Payoff: | -5.54 | ||||||||||

| Absolute Drawdown: | 149.69 | Maximal Drawdown: | 149.69 (6.30%) | Relative Drawdown: | 6.30% (149.69) | ||||||||

| Total Trades: | 27 | Short Positions (won %): | 18 (16.67%) | Long Positions (won %): | 9 (22.22%) | ||||||||

| Profit Trades (% of total): | 5 (18.52%) | Loss trades (% of total): | 22 (81.48%) | ||||||||||