- Using HMs and SSs for with trend entries in fast markets

- trend def: "is the line going mostly up, mostly down, or mostly up and down?)

- trendy Kangaroos are places on the chart where the market has paused to take a rest (3-10 bars in a small consolidation overlapping)

- the HM/SS tail itself must stick out beyond where the market has paused (HM on the downside /SS to the upside) the more it does so the better

- it is impossible for the trendy kangaroo to have space to room to the left

- The trendy Kangaroo does not have to be on on S/R although it is better if it is

- Enter a tick above a HM / below SS... ISL below HM low / above SS high

- Warning: The trendy kangaroo does not occur frequently because the market does not trend that frequently, be careful , there are many trendy kangaroo looking setups that are not ideal

Best Setups Trendy Kangaroos (With Trend HM/SS)

- print during consolidation pause NOT large correction

- stick out of consolidation

- Occur on S/R level major or minor

- O/C contained within prior bar's range

REVERSAL SETUPS

The more space to the left /"air" a possible counter trend reversal has the better as this means the market participants won't have exhausted themselves (ie a level Bulls and Bears have been rowing over very recently will have depleted their supplies and ammo). Generally you want to see 7 bars minimum of "air" before a retouch. Also the more extended the better as it will likely be hitting a long term zone of S/R you can not see on your chart!

(Exhaustion) Reversals p104

Price action at exhaustion reversals will usually be extending beyond where the market has been trading for some time. These are places where the market has simply gone too far

2 types of reversals are...1. "All time" highs: where the market trades at a very high price , before falling and not returning to that high (nb will have reached a S/R level off your screen).... 2. All time Lows: where the market trades at a very low price , before rising and not returning to that low (nb will have reached a S/R level off your screen)These are the areas that traders around the world stare at wishing they had a way of entering on them.What almost all these turning points have in common is "room to the left" , no price action to the left (or "air" between highs/lows). The general rule is the more space to the left, the more likely this spot is a long-term high / low.

Setups with "room to the left" (7 + bars of air) between the last touch of the S/R zone are most reliable.

If you don't get a get a BEP, HM/SS or Harami at a S/R zone then wait for a W / M before counter trend trading.

Chap 6 The Big Shadow (Strong BEP@S/R)

- Strong BEP at top/bottom of a move that prints on an S/R level that has some air between the last touch of it (more the better)

- Must print on a zones at extreme highs or lows of move.

- Big range and Solid close near hi/lo of bar in direction of Rev.

- weakness close nearer midpoint of bar

- Best BEP reach an S/R level that has not been touched for 20-30+ bars. This is "room to left"

- draw a rectangle if needed to aid in identifying how many bars of (air) "room to the left"

Best setups

print at extreme highs and lows

have large ranges than past 10 bars

closes near range extreme

Chap 7 Wammies and Moolahs (W bottom and M top)

- W bottom at S, second bottom is 6+ bars from first low, a HL (market losing momentum) and where you buy on a bullish bar (closing price near high of session), ISL at First High.

- M top at R, second high is 6+ bars from first high, a LH (market losing momentum) and where you sell on a bearish bar (closing price near low of session), ISL at first bottom.

- weakness = multiple touches on S/R

Best Setups

- have many bars between touches

- have catalysts / candle reversals on second touch

- Have significantly lower LH, / Higher HL

- Are on well defined S/R

- Have very few other levels nearby

- Have room to left

Chap 8 Kangaroo Tails

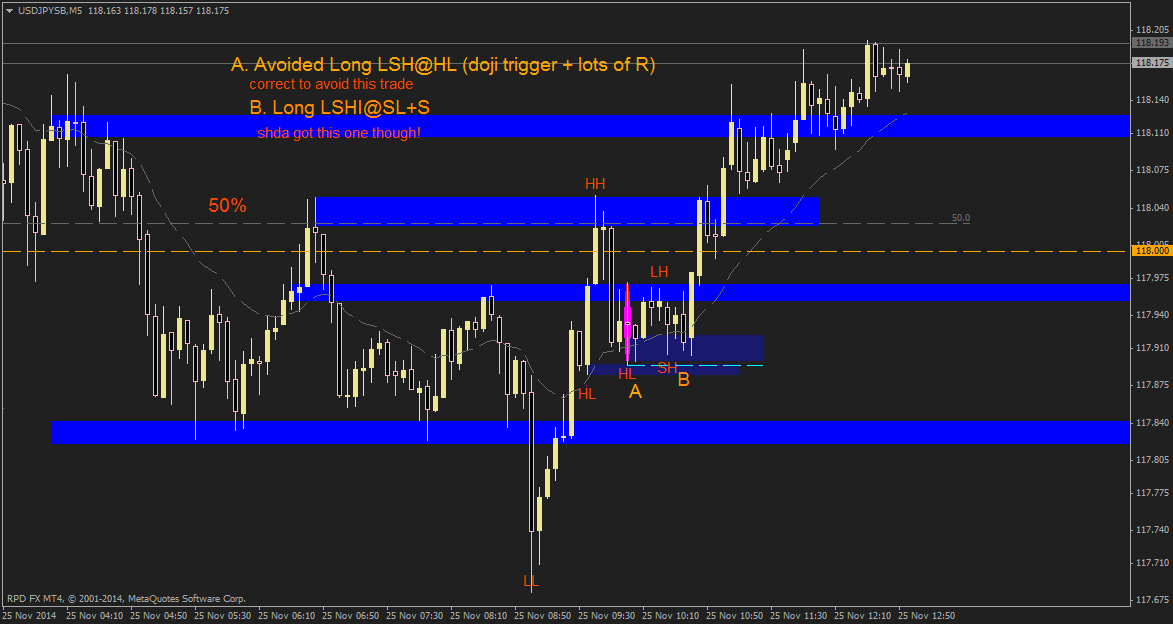

- HM/SS Reversal at S/R or with lots of space to left

- Should be larger than average bar

- beware small tails

- beware triggers that do not print on a zone

- beware triggers whose O/C are not contained in the prior bar's range.

- O/C near the extreme end of bar

- small HMs and SSs are often simply weak pauses in the market so weak triggers

- Beware giant candle sticks, they make make HMs and SSs small and so weak

- the best have a very large range , often greater than the candlestick prior to it

- if in a drawdown of 75% of risk on a HM/SS trade close the position

Best Setups HM/SS Reversals

- The best have very long tails and very short bodies

- print on an area that has not seen PA for a some time (not in a range)

- HMs with close higher than open and SSs with C lower than O.

- Larger (equal to) range than any of the past (5-)10 bars

- O/C should be in prior bars range (HMs/SSs suggest runaway market)

- Ideally at top/bottom of move with at least 7 bars between last touch of S/R

Chap 9 Big Belts: Can't be arsed writing this up as apparently best on D1 Monday charts. basically a dark cloud / Bullish piercing pattern.

_________________________________________________________________________________

PART 3: PSYCHOLOGY

Chap 11: EXITS

Going to include Exits in this section because the words on this really changed the way I thought about my trading.

There are 6 parts to every trade... Exiting is often the hardest!

1. analysis: work out RRR

2. planning stage: create plan

3. entry: enter with odds in favour

4. management: stay aware of what PA tells you

5. exit: make money

6. learning: improve by learning from the past 5 stages

Matching your exits with your psychology: When it comes to exits we all fall into 2 categories: 1. Runners and 2. Gunners. You can know who you are by answering this

Q: Is it more important for you to have a high win rate or to have huge winning trades?

A: For me I certainly fall into the first category because I am a perfectionist....

If you would rather have a high win rate ( as I would), then you will probably have relatively small winners. You may have a high win percentage of winners but the average winning trade will probably be relatively small = Gunners believe the chances of capturing a strong trend are quite minimal. This is why gunners are fine with small consistent profits that they extract from the market (winning is everything to gunners so they struggle in losing streaks.

If you prefer to have huge winning trades this means that many of your trades may end up as losing trades, or break even trades, but the few giant winning trade will make up for these losing trades. = Runner / Patience to wait for the rare but big moves ( Big Profits are everything to Runners. they are confident so confident it does not even diminish in a losing streak). It does not matter which is your style. it is only important that you stick to your chosen style of trading, stick with what you believe. You must trade in a manner that makes sense to you.

Gunner Exits:

Zone Exit: exit at the next zone.

Split Exit: 1st zone then 2nd zone and move SL to BE when 1st PT achieved.

Runner Exits: BLAH not for me so not going to write out.

Chapter 12 The Forex Cycle

It is true that most traders do not consistently find profits, the vast majority of FX traders lose money consistently. Because of this, many traders find it diffiuclt to stick with a trading system... the ironic thing is that the solution has nothing to do with the trading system....Profits do not come from trading systems. Profits come from traders. Traders find profits in the markets, and the tool (trading system) used to extract these profits is not as essential as the trader's execution. The fatal mistake that most traders make is to assume that trading systems are responsible for profits. ( it is my read not the setup that makes me profitable)

Cycle of doom: 1 the search ( for a trading system you love). 2. the action (of the system). 3. the blame (of the system after a drawdown. To become successful you must break this cycle!

To break the cycle first accept that you are caught in this cycle, accept that YOU are responsible for trading profits and losses and Backtest your system to create trust.

Chap 13 Creating your Trading System

once you learn to be an efficet trader, your trading will become boring

Your beliefs wil drive your trading...

the rules:

the rules of your trading system will define how you interact with the amrket, without rules you are simply gambling, your system rules also define what you should do in any situation. entrys exits management and risk. it may be tempting to create a system without precisely defined rules, but know this: a well defined trading system is more likely to withstand your personal psychological attacks against your trading system. "Just this" trading leads to disaters, so it is importnat to develop a system that is "just this" resistant.

Trade specialist: only focuses on one setup ( most like me)

All trades have a beginning (filter for best trades) middle (in trade management from new market movement hi/lo) and end (exit)

TO DO "exit test" and "trading personality quiz" at fxjake.com/book

Patient traders will be able to endure the fluctuations in long term trades, impatient traders will be find this difficult but make very good scalpers.

Dealing with drawn down

1. go away 2. back test. 3. evaluate your trading statement. 4. decide if system still works 5. work on you (when confidence knocked the goal should just be to build it back up with a clear guide, by back testing and employing a positive mindset).

Plan for all things! if you decide on a plan of action before you are in the midst of a high pressure trading decision, you and your trading account will be much better off.

If you exit prematurely , remember the rule is to trade just as if you were back testing it!...If you get very nervous watching your trades then it is probably best that you walk away. However if you can read PA well you may want to update SL during.

Decide if you're a trend or reversal trader

good habits: sleep , take care of body, limit time in front of screen, some quite time alone can recharge the batteries... Make a game out of it, ie can only trade if you exericised or 7 hours+ of sleep . set goals to encourage good habits.

Do you decide to take only those trades that "look" right? or do you take only those trades strictly defined by your trading system? As the pain of missing out is greater for me than the pain of losing I should trade a system.

When you have a good run remember to celebrate your wins!

Key Points:

- are you a market specialist or trade specialist?

- how many hours of screen time do you allow yourself?

- which trading session ?

- which time frames?

- which trading setups?

- which exit strategy?

- how much interpretation on entry?

- how much interpretation on exit?

- Max risk?

- max weekly draw down?

- max monthly draw down?

- how to deal with draw downs?

- how to regain confidence after a draw down?

- how to keep healthy body?

- How to keep healthy mind?

Chapter 14 Becoming an Expert

Some of the very best trades in the world share a simple secret:they use extremely simple and yet powerful trading systems

expert traders do more than simply follow strict risk management controls, they also concentrate on one market, ontrading system, one edge, and usse this edge in their trading repeatedly. Profitable traders are expert s, and these expert traders do one thing over and over again.

if you want to make money as a trader do what the experts do. become good at trading one system. You simply put in practice and become an expert with a trading system that makes sense to you. trade your system over and over again until trading becomes boring (and ver profitable).

the traders that struggle , the traders who have difficultly finding consistent profitsare the ones who repeatedly change their systems, reanalyzing and reorganizing thier trading rules (cycle of doom) ring a bel George?!

what is your expertise? which trading system fits your beliefs? Once you align your beliefs with a trading system, you simply need to gain experience and confidence in the trading system, and you will never look back.

6 Steps to becoming an expert

1. become confident drawing zones on your charts

2. Choose one trading cataylst (setup) that you want to build your expertise on

3. Back test risking 2% or less, triple your acount.

4. Forward test risking 2% or less, triple your acount.

5. Trade a small account risking 2% or less, triple your acount.

6. Trade a Live Account risking 2 % or less on each trade, stick to your trading rules. focus solely on following your system rules

If you find yourself bored with your trading , you are probably consistently profitable. this is when you'll think about changing your strategy. Learning another system isn't necessary but can help reduce risk

Trading should be fun , but if it is exciting, it is a sign the system is unproven or you are risking too much.

Chapter 15 Gaining Confidence

confidence is the most importnatn ingredient for trading success. confidence will help you profit with an average trading system, but without confidence you will be unable to find success, even with a brillinat system... a lack of confidence in the trading system or in yourself are the two confidence issues in trading....most of the time a losing streak is due to the wrong application of the trading system. in other words, most losing streaks are due to misapplication of the system, caused by the trader and not the system itself.

Risk Problems

many prop traders are profitable becuase their is a built in discipline system at a bank... reatil traders do not have risk managers

Changing Systems

if you have a losing streak you may become too careful or too reckless with your trading system... it is imporntant to keep track of what you are doing with a journal

Missing Out

traders may end up with a losing streak simply because they miss out on some trades... the problem is that if winning trtades do not occur that often it is imperative that all trae are taken to make sure the winners are captured...technology may be your answer...the key is to be prepared... use alerts etc

Self COnfidence

confidence does ebb and flow. there are 3 things you can do to combat it,

1. consistently execute your trading system as it was outlined in your system rules. more importnatly you must know , without a doubt , the reason why you have chosen to execute your trading system. basically your beliefs must align with your trading goals/ system.

2. The trading system you employ depends on you. in order to execute it you must have an established routine.... Min rountine must include When will i look for trades? how will i calculate trade size? how often will I check my charts? How will I be alerted to trading opportunities? How will you be alerted when you need to manage trades?

3. the fastest way to regain confidence is to backtest. the simple act of taking 50 trades in Forex tester puts another 50 trades under your belt.

Reasons for losing...

poor execution

changing market

bad technology

dishonest broker

trading system not flexible enough

ARE EXCUSES

Losing trades are really due to one thing - bad luck. Luck will come and go , as you know, the drawn don your experiencing will be temporary and as long as you do not change your rules, you will get it back on track soon. But bad luck is the reason why a trade ends up a loser....Thinking about your next trades in terms of probabilities may help you to refocus on what is important: following your trading system . worrying about any one trade or emphasizing reasons why you trade lost money is not important. the big picture is important, the overall probability of a winning trade is important. a specific trade is not that important..

if you concerned about a recent losing streak for you trading system, compare your historical win rate to the win rate of the last 50 trades. If the historical win rate differs greatly from the current win rate, the trading system maybe losing its potency.

Chapter 16 Managing Risk

risk and trading psyhchologuy are two sides of the same coin

your risk profile: you are the one who knows whether you will make money or not, even though you may not have concious access to this information...your belifs drive your behaviours...if you believe you are worthy of of trading profits, you will be able to make money. if you do not believe your trading will lead to profits , you will not be able to consistently make money. it doesnt mater if youd ecide to work in business or in trading... you win or lose because of your beliefs

attitude to money: if you believe money is good and you are worthy of wealth, money is more likely tocome to you... if you think that rich people simply make loads of money because rich people are very motivated to make moeny. you are much more likely to join the weathy crowd.

GD: I need to start each morning thinking how can I make money!

inproper risk management leads to emotional trading problems

emotional issues are always related to your confidence in trading, the current trade in play or your trading system... but emotional trading is not destructive, the only destructive trading is trading that is not according to your rules....the antidote to overemtional traidng is to apply proper risk managment to your tradesuse a well rehearsed set of trading rules and apply these over and over again in your trading

worst case planning: worst case planning means planning for the maximum loss on each trade. this way , the max loss can;t hurt you. if you walk outside everyday when it's hot the asphalt slowly becomes bearable.