INTRO: Basically I want to figure out what I was doing in my bad months and stop doing that, and what I was doing in my flat months and keep doing that. You can find a rather colourful breakdown of each month at the bottom of this post if you want a headache.

BAD MONTHS:

Number of months major issues were affecting my trading

- Over trading: 1

- Buying at supply, selling at demand: 3

- Under-trading (avoiding /missing): 7

- Method (changing difficulty executing): 4

- Personal Issues (health, external): 2

OK MONTHS:

- Good days were when I was Having Fun/ Playing to win so happy to adapt to PA....

- A lot more trades placed by what looks like labeling highs and lows (being aware of pivot highs and lows), which seemed to keep me in the zone. Trading W bottoms and M tops.

- nice post on persistence.

- Focus on B/B Sweet Spots (focus on supply and demand levels) which I like asking the question " if I were Long/short where would my SL/ PT" be and using those tipping points as entries.

- Trading Al Brooks 20EMA PBs and RLs and SARing if they failed.

OBSERVATIONS:

- trading off the 20EMA really does require a strong trend.

- Could have avoided the low prob with trend trade and SAR'd instead if likely to fail (simply should be looking to short at supply and buy at demand instead of pigheadedly sticking to 20EMA)

- could really start to use alerts!

SUMMARY:

Well this year was diabolically bad. I didn't have one winning month in fact I only managed one winning week. What next? Well there are a myriad of things mentioned above but the points that stand out the most to me are "trading off the 20EMA really does require a strong trend."I should be looking to short at supply and buy at demand instead of pigheadedly sticking to 20EMA setups at/near S&D" and "I could really start to use alerts!"........"Having Fun/ Playing to win", "Being aware of pivot highs and lows"and "being aware of S&D" had a better impact on my trading.

Is Al brooks wrong, are setups off the 20EMA shit? Yes and no it depends on whether they coincide with supply or demand. In his defense he has always said setups off the 20EMA require a strong trend and I have observed that myself this year.

Is Sam Seiden right? are setups off supply and demand right? Ultimately I don't know but surely supply and demand have far more to do with why markets move than the placement of the 20EMA on my chart. There are 2 Al Brooks quote I have written down:

1. "when you're about to take any trade, always ask yourself if the set-up is one of the best of the day. is this the one that institutions have been waiting for all day? if the answer is no and you are not a consistently profitable trader, then you should not take the trade either. if you have 2 consecutive losers within 15 mins or so, ask yourself if those were trades that the institutions have been waiting hours to take. if the answer is no , you are over-trading, and you need to become more patient."

2. "if a trader has the patience to wait possibly hours for a best trade to develop (and he restricted himself to only the trades in this chapter) he would be a very successful trader...the best trades require a lot of patience, patience to occur and patience to work out...learning to restrict yourself to only the very best trades is perhaps the most difficult part of trading. If you are not making money it is something that you must seriously consider...(The single most important trade to avoid until you are skilled is trading within BW (in a volatile range) and a TTR (tight trading range))...many (with trend) setups will look terrible , but you have to trust your read and place your orders or else you will be trapped out of great trades, like so many weak hands...( in a strong trend you do not need setups you can enter at anytime, they merely allow tighter stops)... Once profitable increase size not setups"

I love these quotes but in all honesty I think this applies far more to a S&R/S&D method than that one of waiting for trending market (if you even get one) then waiting pullbacks to the 20EMA. Institutions don't chase price up or down, yes they may add to a ppositionon a rally or pullback but surely they are concentrating on filling there orders at absolute lows or highs.

What next? I'm changing my method to one based on Supply and Demand.... I can't continue trading something I don't believe in (20EMA).

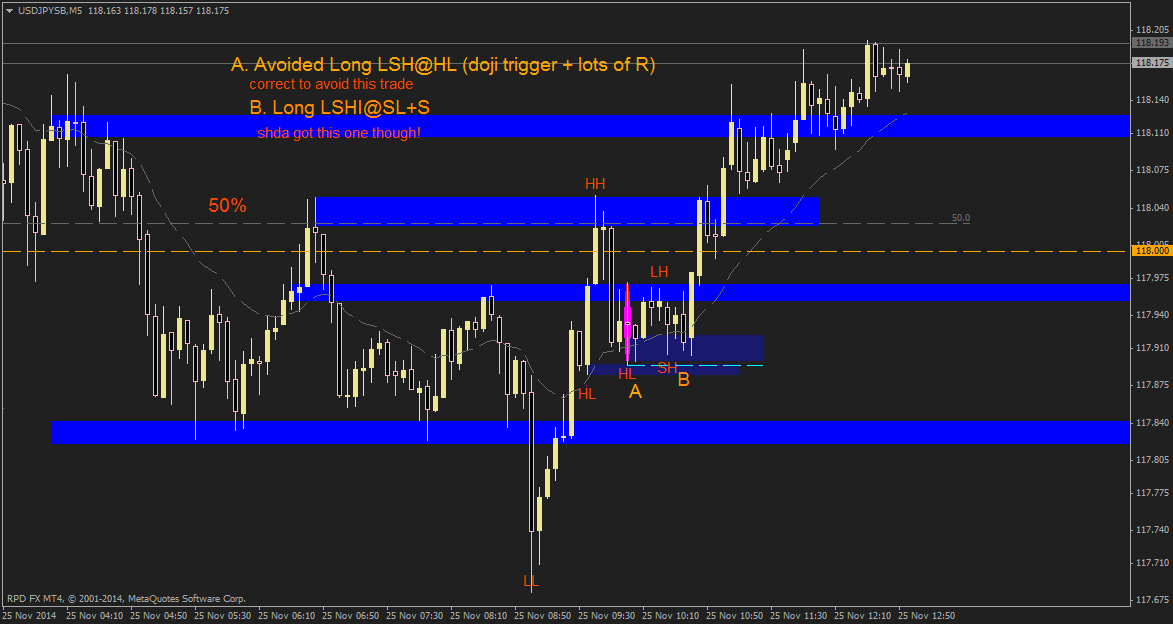

If I base my entries off any pivot highs or lows confirmed by a LSH/HSL and IB's that are confirmed as S/D by a candle pattern, then I will be be basing my strategy entirely around S&D. This will enable me to trade even if there is no trend and easily implement alerts as I will be trading off static levels not a moving average which will reduce workload. On top of that this method will tie in with the behavior of my more positive months: being aware of pivot highs and lows, focusing on supply and demand and having fun/trading to win. Selling high and buying low is a competitive act of trying to get the best price and that is a game/fun in itself... more on a method in the coming days...

As I have written this I have been monitoring the EU M5 chart all day. One of those classic days with clear highs and lows but almost no trend and spotted 4 trades I liked . It would have been entirely useless implementing a 20EMA strategy today the only thing that worked was supply and demand levels!

______________________________________________________________________________________________

January: Over-trading caused by a very sensitive/short term S&R method and taking almost every candle signal.

February: OFF

April: Another month of pretty much AL Brooks Method but looks like I was often not aware of supply and demand areas. I was often buying at supply and selling at demand. Another thing I'd like to note is that trading off the 20EMA really does require a strong trend. or at the very least orderly price action.

May:Still trading Al brooks but with reverted to 8/20 which is a bit slow. Also watching not trading, getting v tentative, also over worried about trading through yesterdays midpoint. Not always aware of supply and demand, not a bad post I wrote on it here. Nice stretch of ISL if a obv level might be tested. Couple of good posts I wrote about my apprehensions 1. S&R double edge sword (also includes a change in plan to ensure I'm trading off S/R+20ema) 2. recent apprehension

June: Again missing lots of trades, serious jitters also missing lots by being away from the charts...could really start to use alerts!

July: Just missing and avoiding LOADS OF TRADES! Quite liked that I wrote "I've got to remember that Uptrends test lows and Downtrends test highs"

August: Missing/Avoiding lots of trades. Started to relax mid month after this post but still missed alot. Good days were when I was Having Fun so happy to adapt to PA.... Bad days I was Not having much fun and feeling stiff so found it hard to react to PA and therefore missing and or adapting trades.

September: Actually a bad month!.Messing with method, a lot of missed/avoided trades.Interesting posts on 1.trading to win 2. tentative ...

November: Over worked, trading too many pairs and complex method. Trading 3 pairs using highs and lows as trend giver, trading off 20EMA and S&R levels very time consuming and tiring, meant I often found myself too warn out and frazzled when the trade setup. Focus on B/B Sweet Spots which I like asking the question " if I were Long/short where would my SL/ PT" be and using those tipping points as entries.

GOOD MONTHS

March: Trading Al Brooks 20EMA PBs and RLs and SARing if they failed. Aware of S&R levels (demand, supply, and 00s/50s) Could have been better had I not bought into supply and sold into demand, I was sometimes taking mechnical entries to literal. Could have instead avoided the low prob with trend trade and SAR'd instead if it was likely to fail.

October: A lot more trades placed by what looks like labeling highs and lows, which seemed to keep me in the zone. Trading W bottoms and M tops. nice post on persistence.

December: Started month trading 3 pairs (EU/EJ/UJ) using highs and lows for direction then reverted to Al Brooks / S&R trading 20EMA on EU only. Missed alot of trades due to external issues.

April: Another month of pretty much AL Brooks Method but looks like I was often not aware of supply and demand areas. I was often buying at supply and selling at demand. Another thing I'd like to note is that trading off the 20EMA really does require a strong trend. or at the very least orderly price action.

May:Still trading Al brooks but with reverted to 8/20 which is a bit slow. Also watching not trading, getting v tentative, also over worried about trading through yesterdays midpoint. Not always aware of supply and demand, not a bad post I wrote on it here. Nice stretch of ISL if a obv level might be tested. Couple of good posts I wrote about my apprehensions 1. S&R double edge sword (also includes a change in plan to ensure I'm trading off S/R+20ema) 2. recent apprehension

June: Again missing lots of trades, serious jitters also missing lots by being away from the charts...could really start to use alerts!

July: Just missing and avoiding LOADS OF TRADES! Quite liked that I wrote "I've got to remember that Uptrends test lows and Downtrends test highs"

August: Missing/Avoiding lots of trades. Started to relax mid month after this post but still missed alot. Good days were when I was Having Fun so happy to adapt to PA.... Bad days I was Not having much fun and feeling stiff so found it hard to react to PA and therefore missing and or adapting trades.

September: Actually a bad month!.Messing with method, a lot of missed/avoided trades.Interesting posts on 1.trading to win 2. tentative ...

November: Over worked, trading too many pairs and complex method. Trading 3 pairs using highs and lows as trend giver, trading off 20EMA and S&R levels very time consuming and tiring, meant I often found myself too warn out and frazzled when the trade setup. Focus on B/B Sweet Spots which I like asking the question " if I were Long/short where would my SL/ PT" be and using those tipping points as entries.

GOOD MONTHS

March: Trading Al Brooks 20EMA PBs and RLs and SARing if they failed. Aware of S&R levels (demand, supply, and 00s/50s) Could have been better had I not bought into supply and sold into demand, I was sometimes taking mechnical entries to literal. Could have instead avoided the low prob with trend trade and SAR'd instead if it was likely to fail.

October: A lot more trades placed by what looks like labeling highs and lows, which seemed to keep me in the zone. Trading W bottoms and M tops. nice post on persistence.

December: Started month trading 3 pairs (EU/EJ/UJ) using highs and lows for direction then reverted to Al Brooks / S&R trading 20EMA on EU only. Missed alot of trades due to external issues.

NOTES from Year

AL BROOKS"if a trader has the patience to wait possibly hours for a best trade to develop and he restricted himself to only the trades in this chapter , he would be a very successful trader...the best trades req alot of patience, patience to occur and patience to work out...learning to restrict yourself to only the very best trades is perhaps the most difficult part of trading. If you are not making money it is something that you must seriously consider...The single most important trade to avoid until you are skilled is trading within BW (in a volatile range) and a TTR (tight trading range)...many WT setups will look terrible , but you have to trust your read and place your orders or else you will be trapped out of great trades, like so many weak hands... in a strong trend you do not need setups you can enter at anytime, they merely allow tighter stops... Once profitable increase size not setups"

ME: ask " if I were Long/short where would my SL/ PT be" then use those tipping points as entries. if you don't get a good entry where they would be taking profit use the level they would have placed their TSLs instead as there will be an influx of orders hitting the market there too.

AL BROOKS"if a trader has the patience to wait possibly hours for a best trade to develop and he restricted himself to only the trades in this chapter , he would be a very successful trader...the best trades req alot of patience, patience to occur and patience to work out...learning to restrict yourself to only the very best trades is perhaps the most difficult part of trading. If you are not making money it is something that you must seriously consider...The single most important trade to avoid until you are skilled is trading within BW (in a volatile range) and a TTR (tight trading range)...many WT setups will look terrible , but you have to trust your read and place your orders or else you will be trapped out of great trades, like so many weak hands... in a strong trend you do not need setups you can enter at anytime, they merely allow tighter stops... Once profitable increase size not setups"

ME: ask " if I were Long/short where would my SL/ PT be" then use those tipping points as entries. if you don't get a good entry where they would be taking profit use the level they would have placed their TSLs instead as there will be an influx of orders hitting the market there too.