EU intraday trades and occasional EU and UC swing trades. Demo account start balance £2374.85

Wednesday, 3 December 2014

Tuesday, 2 December 2014

R-2.5: Mess on the EJ, Much Better on EU

Okay I'm over trading the EJ and UJ now!

TBH I'm still naffing around with my method. Last week Thursday went well on the EU and did something similar today....

EU method:

EJ Trades: Ghastly mess. However one observation on trade 5 might be useful: if price has O/C ( in this case) under a S level, it might be weakened and worth a pass.

TBH I'm still naffing around with my method. Last week Thursday went well on the EU and did something similar today....

EU method:

- Trading with Price to 20EMA,

- Price blw 20ema = short, price abv 20ema = Long.

- Waited for PBs/RLs to 20EMA which coincided with S/R

- Used HSL/LSH as entry, SL low/high trigger, PT next S/R level (this needs to be stretched in all likihood). Also need to start trail the stop: track higher lows if long and lower highs if short.

- one observation on EJ trade 5 might be useful: if price has O/C ( in this case) under a S level, it might be weakened and worth a pass.

EU Trades: need to let profits run!

EJ Trades: Ghastly mess. However one observation on trade 5 might be useful: if price has O/C ( in this case) under a S level, it might be weakened and worth a pass.

Monday, 1 December 2014

R-2.3: Neglected to Label Highs and Lows

Not bad to begin with but trading with disregard to highs and lows is not something I can get away with... resulted in missing a PT and just a shockingly poor short at support. C'est la vie. back on it tomorrow... Also fucking swapped to EJ instead of sticking on EU as preferred the chart action.

EJ trades:

EJ trades:

Sunday, 30 November 2014

24-28th November 2014: R-3.9 (Messing with Method)

Monday: Mixed Day. Some silly mistakes (failing to SAR and taking a doji trigger) and a few nice trades off a well behaved EJ chart.

Tuesday: Lots of Issues. Poor Prep (EU+EJ), Discretionary Exit (EU), Overtrading (EU).

Wednesday: No Trades, Too slow. Too great a work load updating S&R levels and highs on lows on 3 pairs.

Thursday: The Template For all Future Sessions. Simple PBs and RLs to 20EMA(and S/R) and SAR's when failed (EU)

Friday: OFF

Summary: Teething problems (messing with method!) at start of week, settled down on Thursday; Took John's comment on board dropping my work load. waited till actually wanted to trade (US session). Used 20EMA as barometer plus S&R to take trades (meant more of a waiting than "working" game), preprogrammed orders for all trades, walked away for a good deal of the time (updated stop levels occasionally), felt good.

Goal For next Week: Really very simple.... Same as Thursday's Summary...Took John's comment on board dropping my work load. waited till actually wanted to trade (US session). Used 20EMA as barometer plus S&R to take trades (meant more of a waiting than "working" game), preprogrammed orders for all trades, walked away for a good deal of the time (updated stop levels occasionally), felt good.

Friday, 28 November 2014

Online Trading Academy Seminar

Okay, first let me say that I f**king hate seminars. The only reason I went to this one is that John put me on to Sam Seiden (the head training officer at Trading Academy) and I really like his stuff. I had a few queries and thought I might get them answered. I've been to one other 4 years ago and that was enough to make me not want to go to another until today. This was not nearly as bad but still managed to take three and a quarter hours of my life and tell me nothing and will most certainly be my last.

When I asked questions they politely deflected them and when I mentioned that a small part of screen shot looked similar to a Nasdaq level II screen and whether that helped define supply and demand levels this got the "heavy" at the back to shoot up to the front and deflect the question for the speaker. I honestly wasn't being precocious, it just happened to be an unexplained part of the powerpoint slide.

Not that I was remotely entertaining it but the pricing was hysterical... Started at £1000 for 3 day course, they then dropped that instantly to £200!, then said if you place £2000 in an FXCM account you can attend for free! WTF?! Quite a few jumped at the chance but after the "heavy" stepping in at the mention of a possible order flow window and the speaker saying that you simply take trades from levels that Sam Seiden identifies and places on the website (a page which I've never seen on their website!). I can only imagine that much of their income must come from a subscription service, hence the massive subside. Or you're simply paying £200 to be told to subscribe to there service, God knows!

They happily showed trades that they took from supply and demand but would not go into how to they identified them (excluding the "Sam shows us" screen). However examining their charts rightly or wrongly this is what I gleaned...Supply/Demand areas to Buy/Sell from were....

When I asked questions they politely deflected them and when I mentioned that a small part of screen shot looked similar to a Nasdaq level II screen and whether that helped define supply and demand levels this got the "heavy" at the back to shoot up to the front and deflect the question for the speaker. I honestly wasn't being precocious, it just happened to be an unexplained part of the powerpoint slide.

Not that I was remotely entertaining it but the pricing was hysterical... Started at £1000 for 3 day course, they then dropped that instantly to £200!, then said if you place £2000 in an FXCM account you can attend for free! WTF?! Quite a few jumped at the chance but after the "heavy" stepping in at the mention of a possible order flow window and the speaker saying that you simply take trades from levels that Sam Seiden identifies and places on the website (a page which I've never seen on their website!). I can only imagine that much of their income must come from a subscription service, hence the massive subside. Or you're simply paying £200 to be told to subscribe to there service, God knows!

They happily showed trades that they took from supply and demand but would not go into how to they identified them (excluding the "Sam shows us" screen). However examining their charts rightly or wrongly this is what I gleaned...Supply/Demand areas to Buy/Sell from were....

- often a series of small overlapping bars (2+ inside bars) almost like Al Brooks "barbwire".

- Highs where price had dropped off a cliff and had still not returned to yet ("fresh" if you will). Implying that there are still lots of sell orders waiting at that level.

- Lows that price had rocketed from and had still not returned to yet(again "fresh" if you will). Implying that there are still lots of buy orders waiting at that level.

- A trader who was teaching the "£200 course" in the next room came in very briefly and said (and I paraphrase!) this "buy on return to demand, sell on return to supply"(duh!) AND "Big money can be seen, because they have too much of it. It is seen when price can not stay at a level. Meaning not all orders got filled so they have to wait for it to return to this level before recommencing" he also said something about how institutions wait for price

- , not chase price. This I think ties in quite neatly with my observation of interest levels being where price either dropped off a cliff or rocketed to the moon.

That's it. Nothing you couldn't get from reading Sam Seiden articles and examining his charts!

Thursday, 27 November 2014

R-0.1: US Session, Simple PBs and RLs to 20EMA and SAR's when failed (EU)

Don't know what the fuck is going on with my platform but all my chart annotations have vanished after having shut it down my PC this PM vvv annoyed x-/! turns out I could pretty much remember everything...

Woke up 7am GMT, knackered. Felt "body tired" that deep ache all over. Got up did prep than watched the market put trades in front of me and didn't act, it was like watching someone else trade. Realized that this truly was just exhaustion, dimmed screen and had a relaxed morning. Got back to chats around 2 pm GMT gagging to trade and did much better than rest of week. Took John's comment on board dropping my work load. Used 20EMA as barometer plus S&R to take trades, preprogrammed orders for all trades, walked away for a good deal of the time (updated stop levels occasionally), felt good.

EU Trades: Playing around with platform and accidentally closed "1" early. Mini flood in apartment meant missed "B", "2" should have avoided as hammer trigger O/C was outside of prior bar's range!. "3" was a good SAR , worth knowing you can avoid a LSH/HSL and trade its SAR!. "3&4" exit little screwed as placed PT but didn't trigger.

Woke up 7am GMT, knackered. Felt "body tired" that deep ache all over. Got up did prep than watched the market put trades in front of me and didn't act, it was like watching someone else trade. Realized that this truly was just exhaustion, dimmed screen and had a relaxed morning. Got back to chats around 2 pm GMT gagging to trade and did much better than rest of week. Took John's comment on board dropping my work load. Used 20EMA as barometer plus S&R to take trades, preprogrammed orders for all trades, walked away for a good deal of the time (updated stop levels occasionally), felt good.

EU Trades: Playing around with platform and accidentally closed "1" early. Mini flood in apartment meant missed "B", "2" should have avoided as hammer trigger O/C was outside of prior bar's range!. "3" was a good SAR , worth knowing you can avoid a LSH/HSL and trade its SAR!. "3&4" exit little screwed as placed PT but didn't trigger.

Wednesday, 26 November 2014

R-0: Way too Slow to Act, Missed an S Level (EU)

UPDATE: Sitting here this afternoon I can't help thinking I just wasn't enjoying the process M-W, it was not fun in any way and when I have fun I'm relaxed and do better. Had a chat with Brian Holiman recently...

BH:"the word struggling....I think if we just stopped struggling....we'd be good......

GD" you're absolutely right. I think (unnecessarily)"struggling" with obeying my method pretty much sums up my year.".... I WANT/NEED to have FUN.

I hate to change the plan, but damn am I slow. Updating S&R and highs and lows every 5 mins in real-time on 3 pairs is a job and I missed a lot. Wondering if I can take classic PA reversals off major M30+M5 S&R at the top/bottom of a move on a candle reversal (a la Seiden). Then use moving averages (20ema + 240ema), 00s and .50s as a sort of prefilter for with trend PB/RL trades, matched with a bit of S/R respectively to ease up the work load, will try tomorrow.

EU Obs: Got caught up IDing M30 levels, instead of just looking left and labelling the obvious M5 ones

EJ Obs: Sam Seiden(ish) trades

BH:"the word struggling....I think if we just stopped struggling....we'd be good......

GD" you're absolutely right. I think (unnecessarily)"struggling" with obeying my method pretty much sums up my year.".... I WANT/NEED to have FUN.

I hate to change the plan, but damn am I slow. Updating S&R and highs and lows every 5 mins in real-time on 3 pairs is a job and I missed a lot. Wondering if I can take classic PA reversals off major M30+M5 S&R at the top/bottom of a move on a candle reversal (a la Seiden). Then use moving averages (20ema + 240ema), 00s and .50s as a sort of prefilter for with trend PB/RL trades, matched with a bit of S/R respectively to ease up the work load, will try tomorrow.

EU Obs: Got caught up IDing M30 levels, instead of just looking left and labelling the obvious M5 ones

EJ Obs: Sam Seiden(ish) trades

Tuesday, 25 November 2014

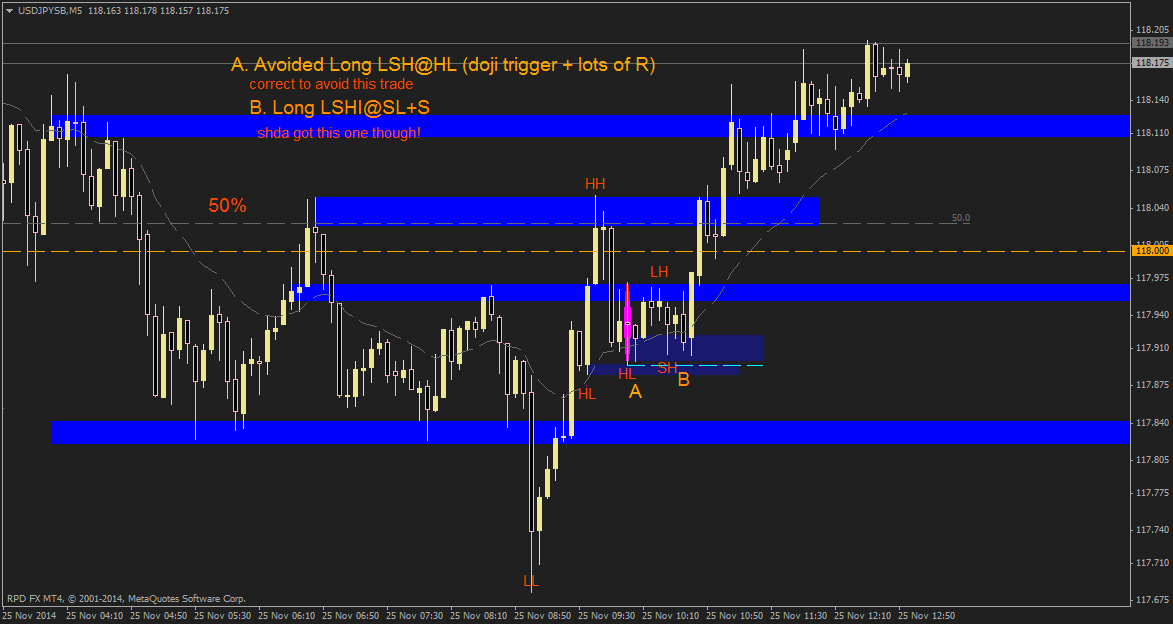

R-0.7: Doji trigger (EU) Good Trades (EJ) Failed to SAR (UJ)

R-3.3: Poor Prep (EU+EJ), Discretionary Exit (EU), Overtrading (EU).

Despite being deep in the red, I think my reads were quite good. The poor result is really more to do with my lack of real time experience; being overwhelmed by the speed of the market and it's impact on my prep and decision making. But I don't believe these are things that can't be fixed simply with more real time practice! This is a demo account, it doesn't matter if I blow it up improving my reaction times.

Things learnt

EU Trades: Poor prep meant missed trade, then "discretionary" exit caused over-trading.

EJ Obs: Missed a good trade because I hadn't clearly marked M30 S/R = colour code M30 and M5 S/R

UJ Obs: correctly avoided a doji trigger, but missed a PB

Things learnt

- Avoid doji triggers (did)

- Colour M30 S&R blue

- Colour M5 S&R dark blue

- Let trades hit their ISL (tipping point) before taking a new position be they LSH/HSL or SARs

EU Trades: Poor prep meant missed trade, then "discretionary" exit caused over-trading.

EJ Obs: Missed a good trade because I hadn't clearly marked M30 S/R = colour code M30 and M5 S/R

UJ Obs: correctly avoided a doji trigger, but missed a PB

Friday, 21 November 2014

17th-21st November 2014 : R-1.1 (Not Following the Plan Or Gaining Experience)

Monday: Off

Tuesday: R+0.7: Long on a PB and Short a M Top (EU) Just trading the plan. But still missed some trades on UJ

Wednesday:R-0.0: Lots of Trades But Quit Early As Not Obeying Plan. Problem was I was keeping up with the highs and lows (that dictate my trades) but I wanted to trade against what they recommended so I quit early as I recognized this and I only create a huge hole when I do this. This actually felt like progress to me... I guess real progress would be telling my brain to shut up and to trade plan, but as any reader of this blog knows I seem to prefer take a million tiny steps instead on one big one...

Thursday:R-1.8: Poor (Doji) Trigger (EJ), Failure to SAR (UJ). Good day despite loss as I finally clarified in my mind what a good and bad doji is but again failed to follow plan (missed trades).

Friday: Off

Summary: The fact is I have been avoiding loads of trades and I need to trade more, to enable me to learn and earn more. Recently I read this email from Paul Wallace

"Whether you’re a Greed Based Trader (GBT) or a Fear Based trader (FBT) you need your discipline to consistently follow either your Risk Management principles (in the case of a GBT) or the discipline to consistently follow your trading plan (in the case of an FBT).... unless someone manages risk or follows their plan with discipline and consistency they're wasting their time."

In all the trading books on psychology I have (Mark Douglas, Ari Kiev etc) I don't believe any have put it as clearly and succinctly, if at all. To be honest I couldn't always understand why I was struggling to move forward. I sorted my risk management out from the start but because I'm risk averse/ FBT, risk management was never really going to be a problem. This email laid it out for me, that my issues are going to be around NOT getting enough exposure to the market... I am a fear based trader and if I am failing to follow my plan (to take the trades it tells me), I am planning to fail! This was a major turning point for me.

Personally I believe my issues derive from what I call the 3P's (psychology, physiology, plan). This weekend I want to address... 1. Psychology: this weekend I want to spend sometime focusing on the positives of taking risks as I obviously gravitate towards the negatives!. 2. Plan: Not changing it but just getting it all down so there's no excuse for not following! (and adding not to trade indecision doji).

Goal For next Week: Really very simple....

Follow the plan for the entirety of my session Monday to Thursday (don't trade Friday's as work late Thursday night). Take every trade it indicates. Never argue with what the High's and Low's say, If I do, don't enter (you will be fighting the market)! Better still fight the urge and do the opposite. Be Realistic with PTs. And keep updating charts in trade!

In all the trading books on psychology I have (Mark Douglas, Ari Kiev etc) I don't believe any have put it as clearly and succinctly, if at all. To be honest I couldn't always understand why I was struggling to move forward. I sorted my risk management out from the start but because I'm risk averse/ FBT, risk management was never really going to be a problem. This email laid it out for me, that my issues are going to be around NOT getting enough exposure to the market... I am a fear based trader and if I am failing to follow my plan (to take the trades it tells me), I am planning to fail! This was a major turning point for me.

Personally I believe my issues derive from what I call the 3P's (psychology, physiology, plan). This weekend I want to address... 1. Psychology: this weekend I want to spend sometime focusing on the positives of taking risks as I obviously gravitate towards the negatives!. 2. Plan: Not changing it but just getting it all down so there's no excuse for not following! (and adding not to trade indecision doji).

Goal For next Week: Really very simple....

Follow the plan for the entirety of my session Monday to Thursday (don't trade Friday's as work late Thursday night). Take every trade it indicates. Never argue with what the High's and Low's say, If I do, don't enter (you will be fighting the market)! Better still fight the urge and do the opposite. Be Realistic with PTs. And keep updating charts in trade!

Thursday, 20 November 2014

R-1.8: Poor (Doji) Trigger (EJ), Failure to SAR (UJ)

Wasn't going to trade today, but received a comment yesterday that gave me a kick up the ass (thanks).

All in the title and charts. But to clarify IMHO...

All in the title and charts. But to clarify IMHO...

- Doji with O/C near top or bottom = okay to trade (practically hammers and shooting stars).

- Doji with O/C in the middle of range = bad to trade (complete indecision)

Wednesday, 19 November 2014

R-0.0: Lots of Trades But Quit Early As Not Obeying Plan

Wrote it up in my summary last week, need to update rules with this though.

"Follow the plan. Never argue with what the High's and Low's say. If you do, don't enter (you will be fighting the market)!" (GOOD)

"Follow the plan. Never argue with what the High's and Low's say. If you do, don't enter (you will be fighting the market)!" (GOOD)

I also wrote...

"Get convergence on entries S/R + (20ema / .00/.50/ YHI/ YLO) . (BAD)Which often makes doing the first statement impossible. As when you see a HL @ S in an uptrend you defy the first statement if it hasn't got another bit of S. So you end up fighting /defying the series of HHs- HLs. The truth as Al Brooks says is you've got to expect price to test the prior high in someway before it reverses. So even if price makes a HL / SL or LL if it's at S I should be trading back into R. So I double guessed the trend and setups so decided to stop in case I ballsed things up...

UJ Obs:

EU Obs

EJ Obs

UJ Obs:

EU Obs

EJ Obs

Tuesday, 18 November 2014

R+0.7: Long on a PB and Short a M Top (EU)

Friday, 14 November 2014

10-14th November 2014: R-1.1 (Some Confusion, Some Anticipation and Trading Overtired)

Monday: Small drop in PL, confusion on SARing at a TSL, turns out I can. Would have been profitable had I.

Tuesday: First upturn in PL, simply followed the plan and shorted a LH at R + 20EMA

Wednesday: Failed to take any trades. Anticipation was caused by passing on a rarely traded CT Short. Retuned how I thought about taking CT trades (It's good to take them because the more experience I build with them the more a part of my arsenal they'll become). Would have been V profitable had I just traded the plan.

Thursday: Second upturn in PL, again simply followed the plan buying a HL at S+.00. Highlighted the importance of getting convergence on my trades.

Friday: Big drop in PL, as failed to follow the plan due to being over-tired and emotions took over rationale. Would have been profitable if I'd just traded the plan!

Summary: The Plan is profitable, I just failed to follow it! I've got to stop trading Friday morning's as I am over tired and struggle to follow the plan. Maybe when I am successfully following the plan for the entire week I can work it back in. Getting an extra reason to get long or short helps trade IE Support/Resistance + (20ema / .00 / .50 / Y Hi / Y Lo)

Goal for next week: Focus solely on what you need to do to make each session successful....

Follow the plan. Never argue with what the High's and Low's say. If you do, don't enter (you will be fighting the market)!

Subscribe to:

Posts (Atom)