IMHO the best teachers give their pupils a physical exercise to achieve the correct psychological mindset (what to concentrate on) for achieving a task. A good example of this is a driving instructor getting their pupils to look in the rear view mirror every two seconds. This exercise makes the pupil observant and while doing so they naturally adjust their speed and distance to match the circumstance. The magic is that the exercise is easier for them to execute than commanding their brain to "be observant".

This is informed observation because they are observing/concentrating on the correct things (front and back), if they were only looking at the Ferrari in front of them, they will more than likely have an accident shortly.

I am not aware of a correct physical exercise (informed observation) for trading. But I do know that the correct mindset (from all that I've read and been taught) is quality over quantity / going for high probability trades, not lots of them. From all that I can understand the highest probability trades are trend trades that occur in some kind of pullback (oversold in an uptrend) or rally (overbought in a downtrend). An argument could also be made for counter trend trades that are overextended from the mean but for now I'm going to keep it simple and just look for trend trades.

I would assume that staying up to date with the trend and it's changes would be the correct physical exercise to help one to trend trade successfully. Focusing on PB and RL are probably most important as these give direction and offer the highest probability trades.

METHOD

An uptrend = a series of Higher Lows ( I should label these and draw a best fit UWTL touching as much as possible. Going for the most obvious TL!)

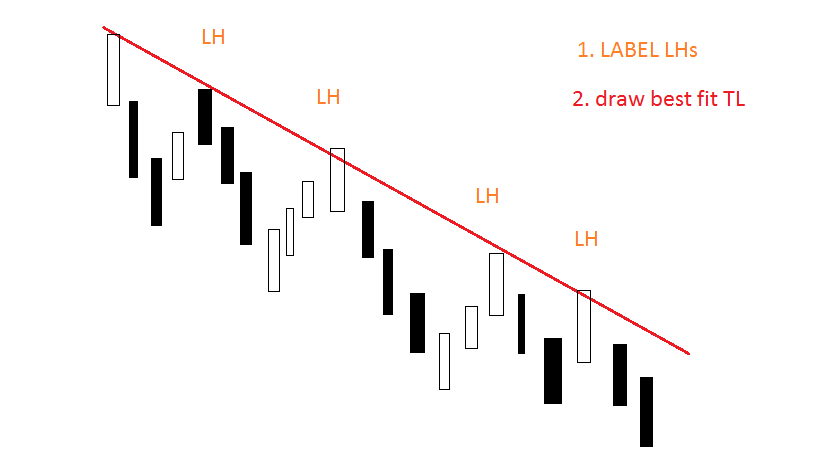

A Downtrend = a series of Lower Highs (I should label each of them and draw a best fit DWTL touching as much as possible,Going for the most obvious TL)

To trade the trend I want to buy when price is Oversold in an uptrend, or Sell when price is overbought in a downtrend. These are the highest probability trades. The best trades are TL and EMA PB/RL or if price can't reach them entering on a 2nd,3rd,4th entry after a new trend extreme.

TL PB Trade

EMA PB Trade

2nd/3rd/4th Entry from Trend Extreme Trade

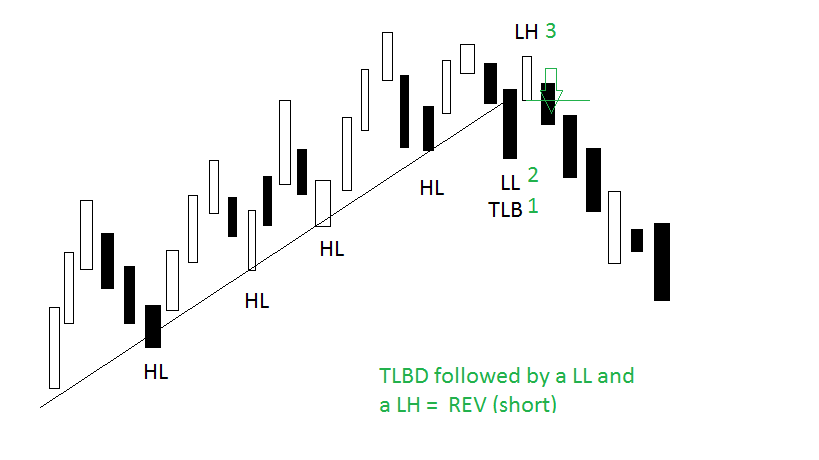

Once a TL is in place you don't need to worry too much about marking HLs/LHs until it breaks as this suggests a possible trend reversal. On a TL break you need to label the last couple of HLs/LHs and continue to do so after the break to see if you have a reversal.

On a TL Break have no bias , be prepared for a trade in either direction, a reversal or a test of the trend extreme.

Uptrend Reversal Trade

Downtrend Reversal Trade

Initial Stop Loss and Trailing Stop Loss Methods

Long SLs

Short SLs

This is informed observation because they are observing/concentrating on the correct things (front and back), if they were only looking at the Ferrari in front of them, they will more than likely have an accident shortly.

I am not aware of a correct physical exercise (informed observation) for trading. But I do know that the correct mindset (from all that I've read and been taught) is quality over quantity / going for high probability trades, not lots of them. From all that I can understand the highest probability trades are trend trades that occur in some kind of pullback (oversold in an uptrend) or rally (overbought in a downtrend). An argument could also be made for counter trend trades that are overextended from the mean but for now I'm going to keep it simple and just look for trend trades.

I would assume that staying up to date with the trend and it's changes would be the correct physical exercise to help one to trend trade successfully. Focusing on PB and RL are probably most important as these give direction and offer the highest probability trades.

METHOD

An uptrend = a series of Higher Lows ( I should label these and draw a best fit UWTL touching as much as possible. Going for the most obvious TL!)

A Downtrend = a series of Lower Highs (I should label each of them and draw a best fit DWTL touching as much as possible,Going for the most obvious TL)

To trade the trend I want to buy when price is Oversold in an uptrend, or Sell when price is overbought in a downtrend. These are the highest probability trades. The best trades are TL and EMA PB/RL or if price can't reach them entering on a 2nd,3rd,4th entry after a new trend extreme.

TL PB Trade

EMA PB Trade

2nd/3rd/4th Entry from Trend Extreme Trade

Once a TL is in place you don't need to worry too much about marking HLs/LHs until it breaks as this suggests a possible trend reversal. On a TL break you need to label the last couple of HLs/LHs and continue to do so after the break to see if you have a reversal.

On a TL Break have no bias , be prepared for a trade in either direction, a reversal or a test of the trend extreme.

Uptrend Reversal Trade

Downtrend Reversal Trade

Initial Stop Loss and Trailing Stop Loss Methods

Long SLs

Short SLs